By their nature, bankruptcies are rarely orderly events. That’s especially true when it comes to the bankruptcies of cities, which are much rarer than the bankruptcies of companies. Municipal bankruptcy problems include figuring out what to do with financial obligations not just to suppliers, landlords, and other private-sector creditors, but to thousands upon thousands of retirees holding public pensions. The good news for retirees is that lots of states have laws making their pensions untouchable, even in a worst-case scenario where a city has to shed millions or billions of dollars in debt very quickly.

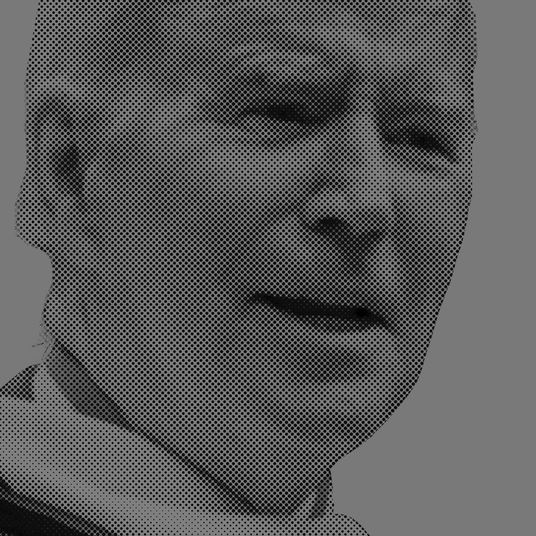

Today, it looks like Detroit — the biggest American city ever to file for bankruptcy — might break the unbreakable rule.

In approving the city’s bankruptcy plan today, Judge Steven W. Rhodes surprised everyone by ruling that Detroit’s pensioners, who are owed about $3.5 billion in unfunded liabilities, could see their pensions cut in the bankruptcy process. This wasn’t supposed to happen — Michigan’s state constitution specifically forbids this kind of pension cut for public workers — but Judge Rhodes ruled that a federal law allowing the cuts could supersede the state law banning them.

Judge Rhodes ruled Tuesday that Michigan’s protections for public pensions ‘do not apply to the federal bankruptcy court,’ adding that pensions are not entitled to ‘any extraordinary attention’ compared with other debts. Labor agreements, including pensions, are subject to changes during a bankruptcy proceeding, the judge said, but the court ‘will not lightly or casually exercise the power to impair pensions.’

Whether or not the Detroit pension cuts end up happening — and it’s likely that they will, in some form and amount — today’s decision represents a major development for the entire country. Four cities in California, for example, are currently wrapped up in negotiations about whether they can cut pensions as part of their bankruptcy petitions. These other efforts to shed debt by cutting pensions might ultimately fail, or be overturned by the Supreme Court. But now that hosing pensioners is possible in Detroit, there’s not much to stop other cities from trying to do the same thing when they run into trouble.