The Red-Hot Rubble of East New York: How Brooklyn’s Gentrification Profiteers Are Expanding Their Boundaries

One of the poorest neighborhoods in Brooklyn is suddenly the focus of both private speculators and City Hall, which wants to build thousands of units of affordable housing there — and by announcing its plans is fueling the land rush.

One drizzly December day, real-estate broker Keith McLaurin was driving a silver minivan down Arlington Avenue in Brooklyn, a few blocks from the East New York station on the Long Island Rail Road. He pulled over in front of an aluminum-sided house with a battered brown awning and called out to the young man on the stoop, whose sweatshirt read IN MEMORY OF WHEN I GAVE A SHIT.

“What’s up?” McLaurin shouted. “Is Ice home?”

McLaurin, an electrician who lives in Brooklyn, moonlights at a firm called Exit All Seasons Realty. He specializes in situations of distress. Before making the house call, he had told me that he works to match homeowners facing foreclosure with private investors who are searching for deals. “They hire me to come in and find these properties,” McLaurin said. “And they’re willing to pay me handsomely to do this.” He said three different prospective buyers were interested in this house. He bounded up its front stairs and through an entryway decorated with faded pictures of the Virgin Mary.

On the psychographic map of a historically segregated city, the sprawling slums of eastern Brooklyn have long been considered too impoverished, crime-ridden, and hazardous for investment. But today, in an economically transformed New York, the territory represents some of the city’s most important—and contested—real estate. Speculators seek profit where others fear to venture. They are rushing toward the margins ahead of an economic upheaval that people in Brooklyn real estate call “the wave.” But the area is equally valuable to Mayor Bill de Blasio, who is eyeing it for affordable housing, his signature political initiative. To both investors and public-policy-makers, the decrepitude of these neighborhoods represents a rare, and perhaps perishing, opportunity. They’re priced for the poor—at least for now.

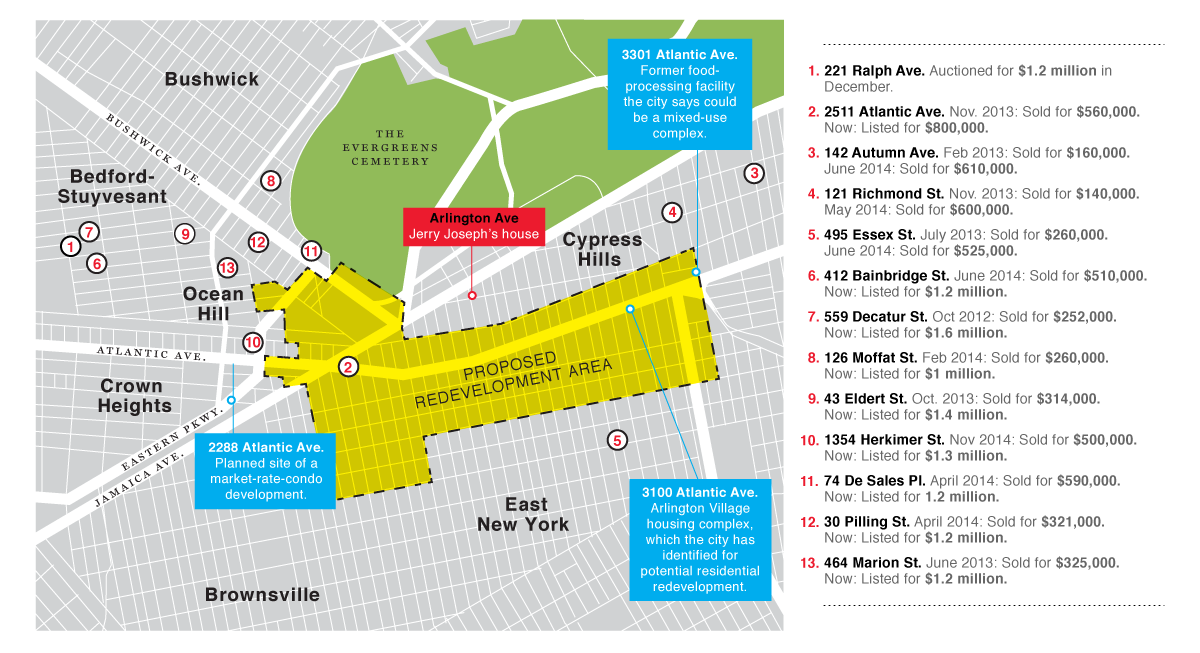

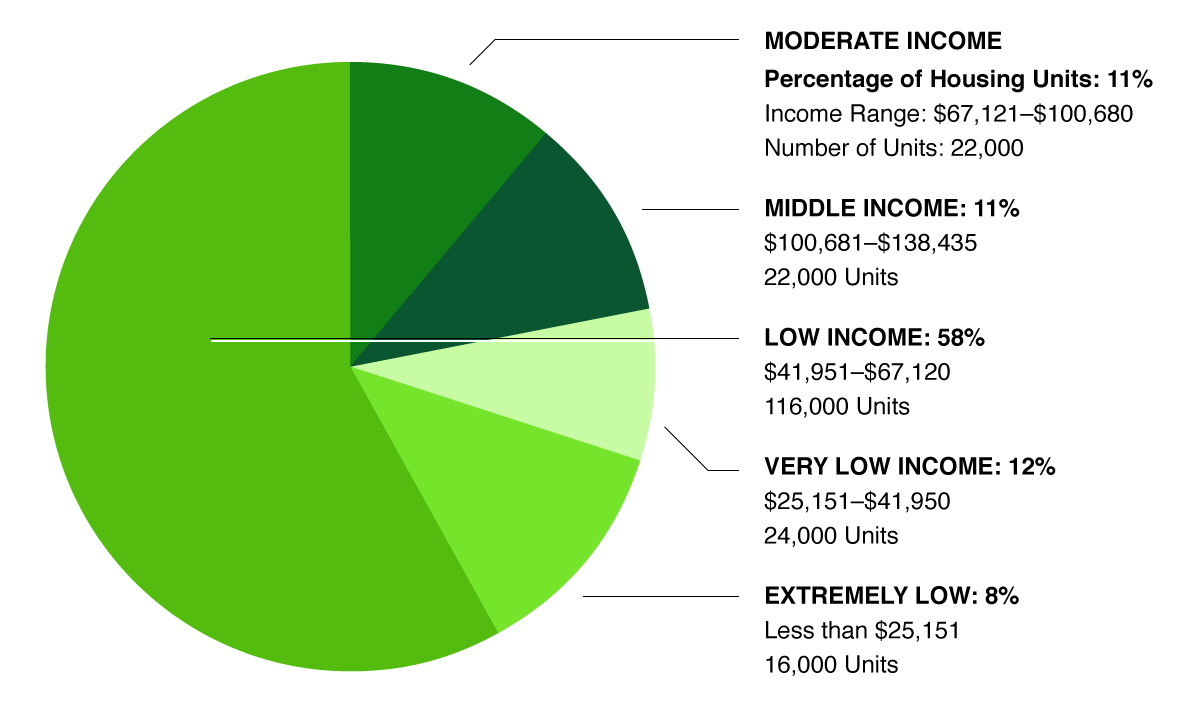

The wave has already churned through Bushwick and Bedford-Stuyvesant, where median home prices have roughly doubled since 2010. As McLaurin stood on Arlington Avenue, a rowhouse on nearby Moffat Street in Bushwick—purchased for $260,000 out of foreclosure last February—was on sale for $1.1 million. But here, just across Cypress Hills cemetery, the median price was only $400,000. The people McLaurin was working with, whom he would identify only as “private investors,” were anticipating that they could get the house for a drastically discounted cost, since it appeared to have a delinquent mortgage. But first, McLaurin would have to persuade the house’s occupants to sell.

Jerry Joseph—“Ice” to his friends—was in his first-floor bedroom, watching daytime television, wearing a fleece sweat-shirt and a winter hat. The house’s heat and electricity had been shut off, and Joseph was siphoning power for the TV from next door. The bank sued to foreclose on the house’s mortgage in 2010, around the time its owner, his stepfather, died of cancer. “Everything, like, you know, crashed,” Joseph said. His mother had since moved in with a daughter, and Joseph said no one had made a payment in years. He gave us a tour, his breath visible as he showed us the kitchen. Joseph’s nephew—the guy on the stoop—lived upstairs, and another bedroom was filled with belongings of the nephew’s two children and their mother. “She’s supposed to move in because she’s getting kicked out of the place where she is right now,” Joseph said. “You know how it is, they can’t be homeless.”

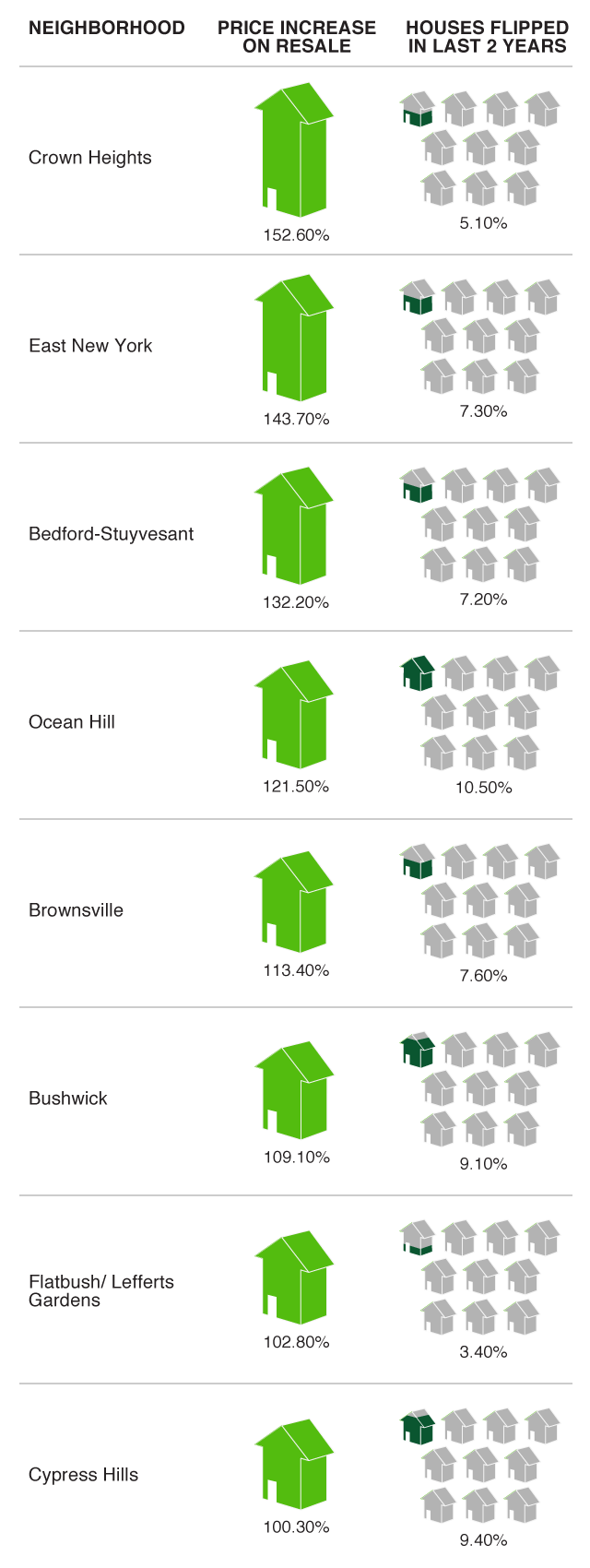

The high cost of housing is a vexing issue for New Yorkers at almost every income level, particularly those in Brooklyn, which was recently identified as America’s least-affordable home market (relative to incomes) by RealtyTrac. What’s a frustration for middle-class buyers amounts to a desperate crisis for poor renters. NYU’s Furman Center for Real Estate and Urban Policy says that more than three-quarters of low-income households in apartments spend a burdensome amount on rent.

De Blasio’s $40 billion housing plan calls for building or preserving 200,000 affordable units citywide, but most of the actual capital investment is supposed to come from the private sector. In wealthy neighborhoods, the city plans to rely on a zoning policy mandating affordable set-asides in new developments. In markets that throw off less heat, the city will use zoning and other incentives to encourage construction. In East New York, the promise of investment has had a perverse effect, pushing land and housing costs higher as speculators try to get in ahead of the redevelopment. According to RealtyTrac, home prices in the redevelopment area’s Zip Codes have risen by 30 to 45 percent over the past two years, and developers say local landowners have recently doubled or tripled asking prices. The more the wave swells, the more expensive it will be to build—and the more elastic the term “affordable” may have to become to meet de Blasio’s goals.

Even as he prospects for property on behalf of speculators, McLaurin recognizes that his neighbors in eastern Brooklyn have a dire need for affordable housing. “I am a victim of a battle within,” he told me. But he says he sees his work as a service to distressed homeowners. McLaurin himself was caught in a bad mortgage back in 2008 and says he learned to navigate a bewildering system. “I offer free advice to those that will listen,” McLaurin said. Of course, it’s hard to advise someone who can’t afford to stay in a house but has no place else to go.

“This is the last chance for the city to get it right,” McLaurin said of the mayor’s initiative. “Because you can’t go any further east in Brooklyn.”

East New York runs south from Atlantic Avenue to the saltwater of Jamaica Bay. To the north and east, its boundaries bleed into Cypress Hills and Brownsville. The city intends to rezone parts of all three neighborhoods this spring, along with a bit of adjacent Ocean Hill, which marketers have lately annexed into Bed-Stuy. “It’s the last frontier,” a Corcoran broker said as he showed me an Ocean Hill brownstone, purchased for $600,000 in August and flipping for $900,000 in November. “Until the next frontier—Brownsville and East New York.”

In 1983, the literary critic Alfred Kazin, born in Brownsville, wrote that the rubble of his neighborhood looked “worse than London did after the blitz.” The decline can be traced directly to an earlier wave of real-estate profiteering. During the 1960s, East New York, long home to factories and laborers, was targeted by speculators known as “blockbusters.” They would circulate rumors of black infiltration among working-class white homeowners, inciting panic sales of properties that could then be resold or rented at exorbitant prices to minorities, who had limited housing options. The public and private sectors aligned in a conspiracy of neglect, and by 1980, the area had lost a third of its population and half of its housing stock to desertion, vandalism, and arson.

The “Wave” Comes to East New York

City planners and speculators are circling the Broadway Junction area.

You can still see vestiges of that end-of-the-world landscape: On one corner of Liberty Avenue, an abandoned Roman-esque police-precinct house stands facing a razor-wired scrapyard full of junked cars. But East New York’s very desolation has made it an attractive laboratory for experiments in affordable housing. During the ’80s, Mayor Ed Koch took advantage of land seized from delinquent taxpayers to turn entire blocks into modular houses, which sold cheap to low-income families. Though hardly beautiful, the homes, along with the low-rise rowhouses and splintering stick frames that survived the blockbusting era, remain a last redoubt of homeownership for the poor.

Unlike Koch, de Blasio can’t seize free land to build affordable housing. Instead, he’s offering developers additional height via a rezoning designed to make it economically feasible to build rental apartments. The plan capitalizes on the neighborhood’s rich transportation options. At Broadway Junction, three subway lines come together with an LIRR route that runs between Atlantic Center and Jamaica. The 3 train juts up from the south. Squint at a subway map, and you can almost foresee a convergence of the brown and gray strands of gentrification emanating out of Williamsburg, the blue strand running through Fort Greene and Bed-Stuy, and the red strand from Prospect Park and Crown Heights.

A few weeks before McLaurin took me out on his house call, he and I watched as City Planning officials publicly presented their vision for revitalization, displaying watercolor renderings of glass apartment buildings, public plazas, and “Under the Elevated,” a proposed space for fairs and art shows beneath a rail line. The 50 or so citizens present, who included activists, pastors, and a few mothers with strollers, were most interested in plans for residential buildings rising eight to 14 stories along four major avenues.

“We know that rents are rising in New York overall, and people are moving to East New York because they are being pushed out of other neighborhoods,” Winston Von Engel, director of the planning agency’s Brooklyn office, said during a breakout session. “There’s only so much land in New York City, especially land that’s near a subway line.”

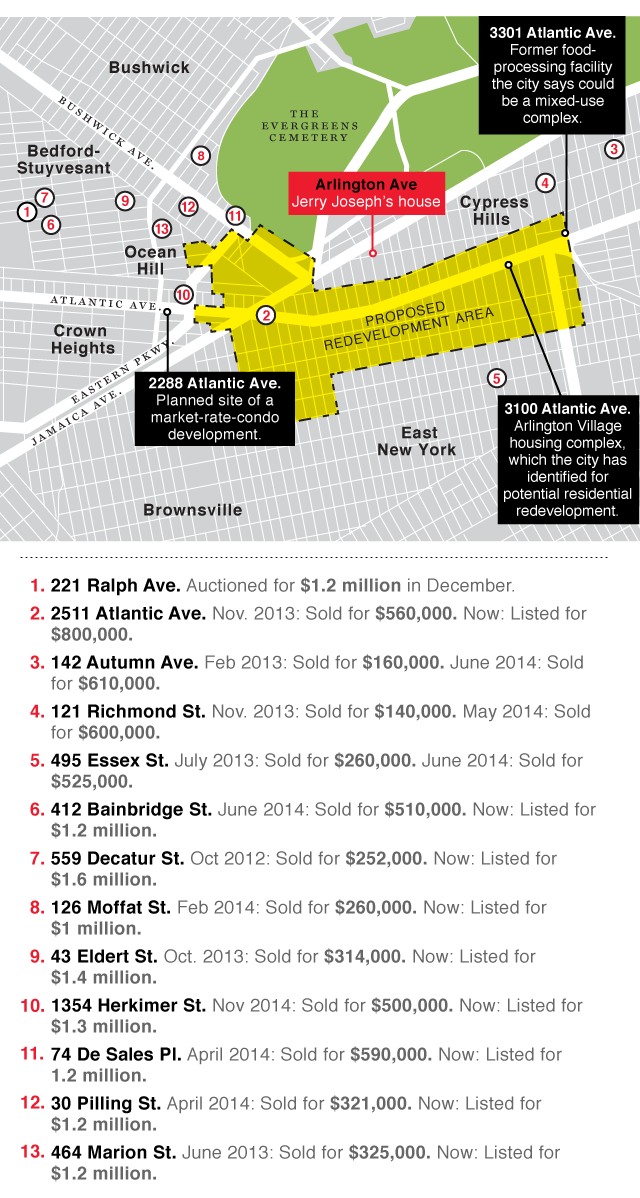

The conversation got heated, however, when city officials were unable to answer a key question. “New homes for who?” asked resident Stephanie Reeder, a schoolteacher. “New housing for who?” According to a citywide policy de Blasio released earlier this year, the vast majority of the 200,000 affordable-housing units will go to households making between $42,000 and $67,000 a year. In East New York, the median income is just $34,000.

“Our community is not as stupid as people like to take us,” says East New York’s state assemblyman, Charles Barron. “If we can’t live in it, we don’t care about the pretty pictures.”

Housing Units

Mayor De Blasio has promised to build or preserve 200,000 affordable housing units, which will be apportioned by income level. Competition is stiff: NextCity recently reported that a family "applying by lottery for a new affordable apartment in Manhattan typically faces odds of more than 400 to one."

City officials say they have yet to settle on the income levels they will target specifically in the new East New York developments. But anyone can see change is coming—if the city doesn’t bring in a richer population, the market-place will. The website New York YIMBY recently reported that a developer plans to build a market-rate building on Atlantic Avenue, a couple of blocks from Broadway Junction. According to market analyst Jonathan Miller, house flipping has accounted for nearly 10 percent of all sale activity in East New York and Cypress Hills over the last two years, with prices more than doubling on average. The vultures are visible on almost every street corner, where signs are nailed to telephone poles: FACING FORECLOSURE? … WE BUY HOUSES & LAND … $ ALL CASH $.

Gentrification is an economic phenomenon fueled by hope and its downside corollary: distress. Eastern Brooklyn has some of the city’s highest rates of foreclosure. If you talk to homeowners there, you hear about the door-knockers, who come around offering quick cash. When I recently visited an open house for a brownstone on Bainbridge Street in eastern Bed-Stuy—bought last June for $510,000, now flipping for $1.2 million—I noticed that adjoining houses had identical laminated signs affixed to their front doors:

DON’T ASK IF WE WANT TO “SELL OUR HOME.”

DON’T ASK IF OUR NEIGHBOR WANTS TO “SELL THEIR HOME.”

NO WE DON’T KNOW WHO DOES … SO DON’T ASK.

Not everyone spurns the approach, however. When I asked Jerry Joseph how he met McLaurin, he replied, “Through God, man. Through God.” McLaurin told me he looks for people in dire straits by sending out mass mailings to addresses that appear on lists of bank liens and by working a network of “guys in the neighborhood,” offering finder’s fees of $500 or $1,000. Joseph was in a typical bind: With penalties and late fees, his family now owed much more than the mortgage’s original $263,000 balance.

Standing in the backyard of the house on Arlington Avenue, Joseph said that his mother, who had inherited the property, felt helpless and was just going to let foreclosure take its course. “That’s what I’m trying to avoid,” McLaurin said. “Because there’s no compensation when the bank steps in.” He said his investors wanted to arrange a short sale, a transaction in which the bank agrees to allow a property to be sold for less than its mortgage balance. The investors would also offer Joseph’s family money up front: maybe $50,000 to his mother for the deed and $5,000 to him for vacating. “It’s called cash for keys,” McLaurin said. Joseph sounded unsure. His $5,000 wouldn’t go far in the rental market.

When Joseph was out of earshot, smoking on the front stoop, McLaurin said he figured his investors could acquire the house for a total of $200,000. “All they do is flip and rehab,” he said. In this case, the home’s second floor could be enlarged to create a rental duplex. With the J train just a block away, McLaurin estimated each unit could fetch $2,000 a month for the investors. “For them,” he said, “it’s a steal at $200,000.”

Who are all these investors? In Bushwick and Bed-Stuy, there are a few high-profile players, like Dixon Advisory, an Australian retirement fund that has recently been buying up dozens of properties—many of them former SROs—for conversion to high-end rentals. But most investors are locally based and stealthy. Several told me off the record that firms like Dixon are latecomers. “There are not any deals in Bed-Stuy,” said one. “I think suckers are buying at $1.2 million thinking they will get $2 million.”

Housing Flips By Neighborhood

House flipping--a speculative phenomenon more commonly associated with Florida or Las Vegas--has recently become commonplace in the inflating market of eastern Brooklyn. The appraiser and housing market analyst Jonathan Miller counts nearly 700 flips in the area over the last two years, with prices more than doubling on average. The gentrifiying neighborhoods of Bushwick and Bedford-Stuyvesant showed the most intense activity, but East New York wasn't far behind.

While most successful speculators tend to shun attention, I happened to know someone who could explain the game. Craig Stuart Lanza is a friend, a former Brooklyn prosecutor who now represents several investors in distressed properties. They belong to a cohort of businessmen—many of them Hasidic—who have ridden the wave east from Williamsburg. “They’ve become incredibly wealthy,” Lanza says, but they face a supply problem. “They’re running out of slums.”

Brooklyn’s speculators have developed sophisticated systems for securing inventory. The door-knockers and the short-sale brokers concentrate on finding sellers. They feed houses to deed investors, who front the cash necessary to get a property into contract. The contract itself can be flipped before closing. Often it ends up with another speculator who specializes in renovating. (Because of this off-the-books activity, the margin on a $200,000 property that flips for $1 million may be smaller than it appears.) In the background, there are hard-money lenders who finance the kind of risky deals banks won’t touch, charging high interest rates. The hard-money lender may actually be hoping for a default so that he ends up owning the property himself.

It’s a secretive business, but Lanza said he could introduce me to someone in the thick of it. We met up one day at the Brooklyn courthouse, where he first had to attend to a foreclosure auction. “This is going to be a hoot!” Lanza said. He looks like Paul Giamatti and was wearing a long camel-hair coat. The courtroom was crammed with bidders of all ethnicities. Bearded speculators murmuring in Arabic sat by bearded speculators murmuring in Yiddish. Two chatting strangers near me discovered they were both from China. Lanza sat to one side, conferring with a client, a Hasidic man in a black fur hat who specializes in buying distressed mortgages from hedge funds at a discount and foreclosing. He had a property up for auction: a four-story brick tenement on Ralph Avenue, across the street from the Brevoort Houses in Bed-Stuy. After frenzied bidding, the building sold for $1.2 million.

Then Lanza and I walked over to Atlantic Avenue to meet a client who was willing to talk: an investor named Isaac who has been flipping houses for more than a decade. As we hopped into the back of his white BMW, Lanza related the results of the auction and Isaac gave a disbelieving whistle.

“221 Ralph?” he said. “So much money!”

With his business partner, Isaac has bought and renovated about 80 properties, mostly in Bushwick and Bed-Stuy. “I will not buy in that area anymore,” he told me over dinner at a falafel joint. “I am looking outside to buy.” One area where he is investing is East New York. “If you ask me whether East New York is going to be Bed-Stuy, with the coffee shops and cool people, it’s going to be a long time,” Isaac said. But the area is getting incrementally more affluent as the working class supplants the extremely poor.

“Where are those people going to live?” Isaac wondered. “But I cannot be the welfare guy.” He figures he can bide his time, collecting rent, and profit as the city evolves. “If you want to make money,” he says, “you make money when everyone else is asleep.”

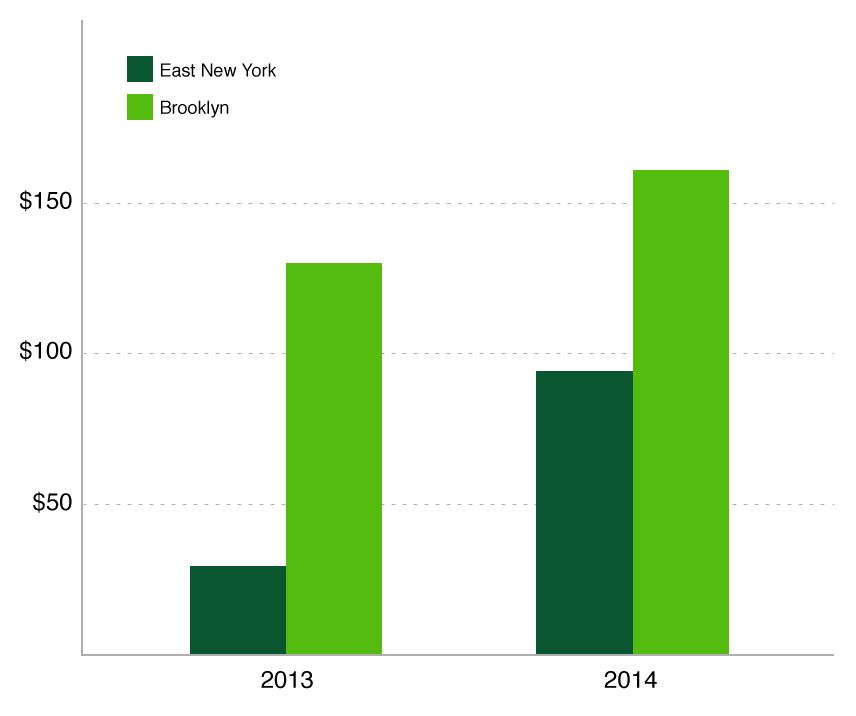

Price Per Buildable Square Foot

In 2013, development sites in East New York cost just a quarter of the going price in Brooklyn overall. But since De Blasio announced his redevelopment plan, landowners have increased their prices dramatically. (Data courtesy of Massey Knakal Realty Services.)

Others have awakened to the possibilities. “Everybody always buys land in front of a proposed rezoning,” says Alicia Glen, the deputy mayor who is overseeing the housing plan. A former Goldman Sachs executive, she coolly sized up the economics, saying the development incentives would come with stringent conditions. “Nobody in New York City has bought land in front of a proposed zoning that requires you to build affordable housing. So all these geniuses out there, who knows? I suspect that some of them are going to wind up having overpaid for their land—and by the way, that’s not my problem.”

In the next breath, though, Glen said, “I’m not here to be punitive. We want these guys to build.” Cheap land is the precondition that is supposed to make East New York’s affordable redevelopment possible. As costs rise, developers will have to maintain their profit margins by demanding either higher rents or larger city subsidies. But spending more on each project will make it harder for de Blasio to get to that big round number he has promised: 200,000 units. Thus, the city has an incentive to target households that can contribute decent rent. A million households make below $42,000 a year, and 575,000 of them lack affordable housing, according to city estimates. Yet they stand to receive only 40,000 units, fewer than will go to households earning between $67,000 and $138,000.

“There is always going to be a tension between production and other extremely important goals,” Glen conceded. “It’s just math.”

People in East New York can also add up the numbers, and that explains why some local activists are now organizing to fight City Hall. “I think people have a right to be skeptical,” says Michelle Neugebauer, executive director of the Cypress Hills Local Development Corporation. She led a December meeting for a group called the Coalition for Community Advancement, whose members are vowing to oppose the rezoning plan if it doesn’t require the new developments to be priced for local incomes. Pastor Preston Harrington, a jovial community leader, closed the meeting with a prayer. “God, where you have joined us together,” he said, “let no man—no city planner—put us asunder.”

When we met soon afterward, Glen couldn’t quite seem to fathom the opposition. “They don’t want their children or neighbors to be displaced,” she said. “But I don’t think people think it’s terrible to have cops and teachers moving into their neighborhood.” The city’s plan for East New York includes more than new buildings: transit improvements, pedestrian-friendly streets, better shopping, and, most important, programs that will fund renovations in privately owned buildings in return for rent controls. Glen’s aim is to channel Brooklyn’s wave for public benefit. “We can’t be naïve and think we can stop development in its tracks,” she said. “We see what’s coming around the corner.”

Of course, so do the profiteers. One afternoon, Neugebauer’s colleague at the Cypress Hill LDC Lisa Maldonado showed me a site the city’s rezoning study singled out as primed for redevelopment: Arlington Village, a woebegone barrackslike complex on Atlantic Avenue originally built for returning World War II veterans. “The owner has been holding out forever,” she said. We also looked at several houses that recently flipped in the half-million-dollar range, ending up at a vinyl-sided home on Autumn Avenue, purchased for $160,000 in 2013 by an LLC, renovated, and sold to a family for $610,000 last June.

“The secret is out,” Maldonado had said when we returned to her office, where we were joined by Neugebauer.

“Please don’t put that in the article!” Neugebauer interjected. “We don’t want to sell this as the place the hipsters should come to.”

Percentage of Income for Median Home by County

The firm RealtyTrac's affordability index measures the media home price in an area against its median household income. The index surpassed 50 percent in only 19 markets, mainly in New York and California. In Brooklyn, the affordability index stands at 98 percent--meaning a typical household would have to spend nearly all its monthly income to pay the mortgage on a typical home. That makes it America's least affordable home market.

It’s a disorienting political dynamic. After years of praying for housing, prosperity, and attention, local leaders are now resisting the idea of a revival imposed from above. But their wariness becomes more understandable once you realize that the bars, bikes, and bohemians are really lagging indicators of a more brutal market phenomenon. As the rich push the middle class out of brownstone Brooklyn, the middle class has been left with an unenviable choice: leave or compete with the truly poor.

The speculators may have to wait to buy Jerry Joseph’s house, though. I asked Craig Lanza to look at his foreclosure case. He called me back, bellowing, “That mortgage cannot be foreclosed!” He surmised that somewhere along the line, as the loan was sold from one bank to another, someone made a paperwork mistake. This happens frequently. Sometimes a mortgage can even be completely wiped off the books because a six-year statute of limitations has expired. “The system is fucked,” Lanza said.

Joseph’s foreclosure case has been discontinued for the time being, though he sounded surprised to hear it. His mortgage servicer certainly isn’t letting on when it sends threatening collection notices. McLaurin still hopes to arrange a short sale, since the foreclosure could be revived. For now, though, one poor household is still living, shivering, in an extremely affordable house on Arlington Avenue.

*This article appears in the January 26, 2015 issue of New York Magazine.